Employers in the U.S. are facing a turning point. As healthcare costs continue to climb—and with pressures from inflation, specialty drugs, cardiometabolic conditions, and evolving benefit expectations—2026 is shaping up to be one of the most challenging years yet for plan sponsors. Organizations that take bold, data-driven action now will be best positioned to protect both their bottom lines and their people’s health.

This report provides a comprehensive forecast of what employers should expect in 2026, what levers they can pull to contain costs, and how wellness programs, digital coaching, and behavior-change strategies can drive real ROI.

Key Trends & Projections for 2026

1. Projected Cost Increases

Employers anticipate ~9% median growth in overall healthcare costs in 2026. However, with strategic benefit plan design, it is expected that cost increases could moderate to ~7.6%. Similarly, Mercer predicts the total health benefit cost per employee will rise 6.5% on average once planned cost-reduction measures.

Medical and prescription drug inflation, as well as increases in utilization, are major drivers of these trends. Employers will need to be strategic in selecting programs and plan design to manage rising costs to the lowest possible increase without compromising member access.

2. Cardiometabolic Conditions Driving Costs

Prescription drug spending continues to increase, with significant contributions from GLP-1s, cancer therapies, and specialty medications. Cardiometabolic conditions—diabetes, obesity, hypertension, and cardiovascular disease—continue to grow in prevalence while driving healthcare costs for employers. As these conditions increase, so does the demand for GLP-1s to treat them.

Treating the complexities of cardiometabolic conditions drives greater utilization of our healthcare system, combined with the increased pressure for employers to cover GLP-1s, which creates an unmanageable health crisis.

3. Retention & Affordability Implications

As health plan costs continue to rise, employers face a difficult choice: absorb the increases or pass them on to employees. Mercer’s data shows a growing trend toward the latter, with the percentage of employers likely to make plan design changes that shift costs to employees rising from 45% in 2025 to 51% in 2026.

This shift poses a major risk to employee retention, well-being, and productivity. Paytient found that 40% of US workers delay healthcare due to cost, even when covered by employer-sponsored plans.

For many organizations, rising costs threaten affordability for both employers and employees, including higher premiums, increased out-of-pocket costs, and higher cost-sharing.

What Employers Can Do To Improve Outcomes

Employers that act now can mitigate the impact of rising costs, improve health outcomes, and protect both the financial health of the organization and the well-being of their workforce. Here are proven, strategic levers:

1. Benefit Design Redesign

Adjust cost-sharing structures (co-pays, deductibles, and coinsurance) carefully to preserve access while managing unnecessary utilization with programs designed to address holistic member health.

Utilize high-performance networks, centers of excellence for certain categories of expensive care, to maximize outcomes.

Work with your benefit advisor or PBM for efficient formulary management designed to prioritize generic utilization, leverage biosimilars, and negotiate pricing with specialty drugs.

2. Cardiometabolic Condition Management & Digital Coaching

Invest in proactive cardiometabolic disease management programs to empower your members to manage conditions like obesity, diabetes, and hypertension and ultimately, maximize your healthcare investment

Digital, connected, and scalable solutions offer continuous support to support members at any time. These solutions should offer your members customization that adjusts based on their evolving needs and has the ability to integrate with their preferred care team. The most innovative programs offer a balance of AI and human coaching to deliver effective support for improved health outcomes within your benefits budget.

Effective cardiometabolic condition management programs help your members better manage their conditions by understanding how daily lifestyle changes can significantly impact their health. With connected devices, these programs can collect data from each member in real-time, enabling your plan to make faster, informed decisions on care. With the right adjustments and data, your plan can more effectively manage the rising costs associated with cardiometabolic conditions.

3. Preventive Care & Wellness Programs

Studies show strong ROI for wellness initiatives with one meta-analysis finding medical cost savings of ~$3.27 for every $1 invested in well-designed wellness programs. Another study from RAND showed that for people with chronic disease, every dollar invested in managing chronic conditions produced about $3.78 in savings.

Providing members with tools to learn how to manage their condition and take action to change behavior pays off in overall medical costs. But, most importantly, it provides members with an opportunity to live healthier lives which is invaluable to their overall quality of life.

4. Pharmacy Benefit Innovation

It is undeniable that pharmacy spend is on the rise, with a near 10% increase in 2024 and another projected increase of 8% by the end of 2025. At an average monthly cost of $1,300 per utilizing member, GLP-1s are a significant cost concern for employers, particularly with sales projected to hit $157B by 2023.

Employers have an opportunity to get ahead of these projections with plan design that leverages clinically appropriate cost containment through prior authorization optimization, employee expense reimbursement programs, and wrap-around support programs that promote the success of the medication.

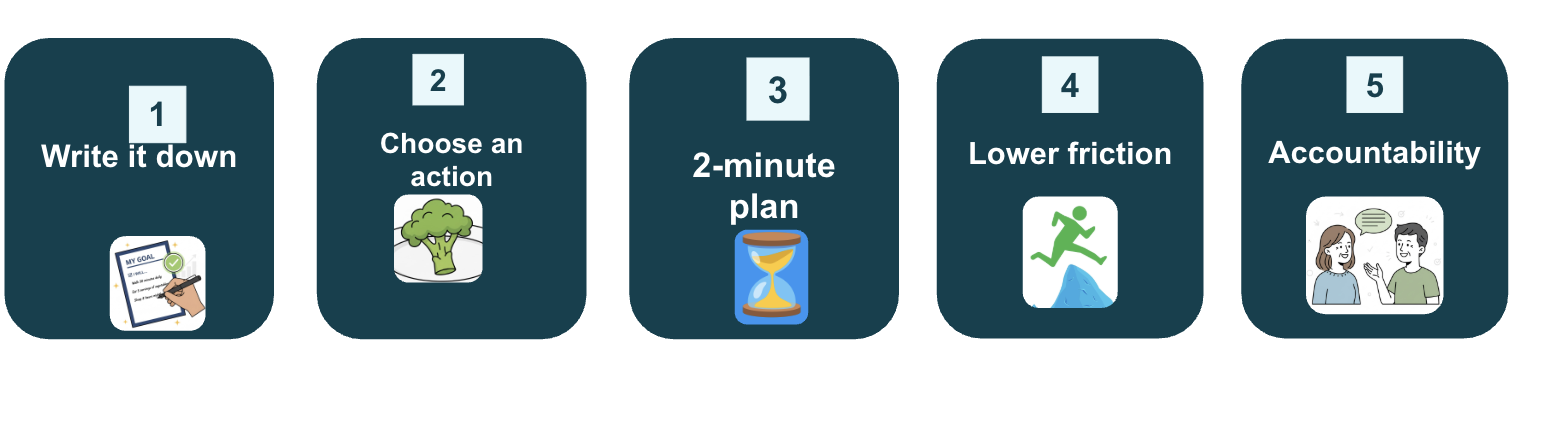

5. Member Engagement & Behavior Change

Prioritize programs that leverage proven, clinically validated frameworks like CBT and have been endorsed or reviewed by reputable healthcare entities. Programs that have been vetted and demonstrated measurable results with sustainable ROI are more likely to help sustain healthy behaviors that reduce future cost burden.

Many programs rely on static models that apply a one-size-fits-all approach. It is imperative to seek programs that adapt to each member’s needs based on their current conditions, medications, and dietary preferences or restrictions. These factors not only ensure effectiveness but can improve engagement.

6. Strategic Vendor Partnerships & Simplification

HR and benefits leaders are balancing more point solutions than ever creating unnecessary complexity. Members are also feeling the point solution fatigue trying to balance several applications for different conditions, leading to frustration and disengagement. Instead of multiple point solutions, select partners that can integrate across several conditions to reduce vendor fatigue without sacrificing outcomes.

What Makes a Strategy “Bold” in 2026

To truly move the needle, employers will need to consider innovative strategies. Here are some bold moves to consider:

- Shifting from reactive to preventive models: Rather than paying for complications, invest upstream in programs that prevent disease onset or progression.

- Integrating AI + human care: Hybrid models that scale via AI but escalate to human support when needed, so you preserve empathy and ensure safety.

- Behavioral health integrated into benefits: Mental health comorbidity significantly worsens outcomes and costs in chronic disease. Ensure all programs implemented consider this and account for it in their model.

- Address GLP-1 pressures not just by restricting access, but by offering sustainable alternatives and companion programs (coaching, lifestyle interventions) to maximize outcomes and reduce long-term cost.

- Full spectrum care platforms: One platform for obesity, hypertension, and diabetes, rather than siloed vendors, to drive sustained engagement that delivers results

Imperative for Employers in 2026

Those who wait risk facing unsustainable plan costs, adverse employee experiences, higher turnover, lower satisfaction, and shrinking margins.

Suggested Next Steps:

1. Review your current benefit design and model potential cost exposure under multiple scenarios.

2. Evaluate digital coaching programs for ROI + alignment to risk segments.

3. Explore pharmacy strategy (prior authorization, formulary, cost controls) with your benefits advisor and PBM

4. Select vendor partners who offer data transparency, scalability, human-in-the-loop care models

5. Contact Lark to learn more about how a comprehensive, scaleable cardiometabolic prgram can help unlock savings and measurable outcomes in 2026 and beyond.

.png)

.webp)

-images-0.jpg)